Afentra acquires stake in two blocks offshore Angola

Afentra acquires stake in two blocks offshore Angola. Afentra expects to sell its first cargo of crude oil in the third quarter of this year.

British oil and gas company Afentra has concluded the acquisition of a 4% stake in two blocks offshore Angola from Croatia’s INA-Industrija Nafte.

The acquisition in Block 3/05 and Block 3/05A marks Afentra’s foray into the Angola oil and gas space.

In April, Block 3/05’s gross output averaged 19,000 barrels of oil per day.

Afentra noted that its working interest in Block 3/05A would increase from 4% to 5.33%, subject to final approval of the allocation of the China Sonangol International interest to the remaining joint venture partners.

The deal, which was first announced in July 2022, received the nod from Angola’s Ministry of Mineral Resources, Oil and Gas in January 2023.

Afentra CEO Paul McDade said: “The indicative transaction metrics upon sale of crude inventories speak to the competitiveness with which we have been able to structure this deal and we are pleased to mark the inception of our partnership with Sonangol in Blocks 3/05 and 3/05A.

“It is also highly encouraging that the terms for the Block 3/05 licence extension award have been agreed; this represents a major step towards completion of the Sonangol transaction within our previously guided timeline.”

The deal, according to the British company, results in a net upfront consideration of $17m, which is mitigated by the company inheriting crude oil stock with a value of around $16.6m at $80 per barrel.

Additionally, the company has set aside $10m as a “escrow deposit at completion” that will be paid to INA following the formal completion of the Block 3/05 licence extension.

Afentra also noted that it expects to sell its first cargo of crude oil in the third quarter of this year.

With delays out of the way, UK oil & gas firm enters Angola

UK-headquartered and AIM-listed company Afentra plc has completed the acquisition of interests in two blocks offshore Angola from Croatia’s INA-Industrija Nafte. This marks the UK player’s entry into Angola.

Following a sale and purchase agreement (SPA) from July 2022, Afentra announced the receipt of approval from Angola’s Ministry of Mineral Resources, Oil and Gas in January 2023 for the acquisition of a 4 per cent interest in Block 3/05 and a 4 per cent interest in Block 3/05A offshore Angola from INA-Industrija Nafte. Due to documentation delays, the process took longer than anticipated, however, the UK player announced the completion of the acquisition on Wednesday, 10 May 2023.

As a result, the company believes to be “well positioned” to build a material production business in Angola and contribute to “a responsible energy transition for the country.” According to Afentra, the transaction effective date of 30 September 2021 results in a net upfront consideration at the completion of $17 million, which is offset by the firm inheriting crude oil stock with an approximate value of $16.6 million at $80/bbl (207,868 bbls).

Moreover, the company also set aside $10 million into an escrow deposit at completion, which will be paid to INA after the Block 3/05 licence extension is formally completed. The net upfront consideration and escrow deposit will be funded by $18.9 million from the agreed reserve based lending (RBL) and working capital facilities and $8.1 million from cash resources.

Furthermore, the upfront consideration of $17 million comprises a $12 million initial consideration, $4.8 million in working capital and interest and $2 million in payments of crystallised contingent consideration, adjusted downwards by $1.8 million due to positive net asset cashflows. The UK player confirmed that Mauritius Commercial Bank (MCB) had entered both the RBL and working capital facilities as the lender to the company. As Trafigura retains an interest in the RBL facility, it will continue as an offtake provider for the Block 3/05 crude..

Afentra expects to sell its first cargo of crude oil in 3Q 2023, monetising the inherited crude oil stock and subsequent production. While Block 3/05 current gross production in April averaged approximately 19,000 bbl/d (net 760 bbl/d), the production in 1Q 2023 averaged 17,206 bbl/d as a result of downtime experienced through planned restoration works on power generation and the distribution network.

After ERCE completed its annual update of the Competent Persons Report (CPR) on the Block 3/05 assets with an effective date of 1 January 2023, the updated 2P gross reserves are 108 mmbbls (net 4.3 mmbbls) and the updated 2C gross resources are 43 mmbbls (net 1.7 mmbbls). In addition, long-term testing started in Block 3/05A, at the Gazela field, of an additional circa 1,100 bbl/d, enabling the framing of potential development options.

Paul McDade, Afentra’s CEO, commented: “We are very pleased to complete the INA acquisition and we would like to thank all involved, especially our shareholders, for their continued patience and support. The indicative transaction metrics upon sale of crude inventories speak to the competitiveness with which we have been able to structure this deal and we are pleased to mark the inception of our partnership with Sonangol in Blocks 3/05 and 3/05A.”

Block 3/05, located in the Lower Congo Basin, consists of eight mature producing fields discovered by Elf Petroleum – now part of TotalEnergies – in the early 1980s. This block has a diverse portfolio of over 100 wells. Currently, it produces from around 40 production wells with nine active water injectors. The facilities include 17 wellhead and support platforms and four processing platforms, with oil exported via the FSO Palanca.

What’s happening with the Sonangol acquisition?

Based on the SPA signed on 28 April 2022 between Afentra’s wholly-owned subsidiary and Sonangol regarding the purchase of non-operating interests in Block 3/05 (20 per cent) and Block 23 (40 per cent) offshore Angola, an important condition precedent for the Sonangol acquisition is the approval of the extension of the Block 3/05 production sharing agreement (PSA) until at least 31 December 2040.

In its update on the progress of this acquisition, Afentra highlighted that the Block 3/05 JV partners and ANPG, the Angolan oil and gas regulator, had agreed on the terms of the Block 3/05 licence extension, extending the production sharing agreement from 1 July 2025 to 31 December 2040 with improved fiscal terms that strengthen the economics of the permit.

In light of this, ANPG will now begin the process of obtaining the requisite governmental approvals for the licence extension. Afentra claims that the agreement between ANPG and the JV partners on the terms for the licence extension, allows Sonangol to start the process of obtaining the requisite government approvals for the Sonangol transaction which remains on track to be completed by 30 June 2023.

“It is also highly encouraging that the terms for the Block 3/05 licence extension award have been agreed; this represents a major step towards completion of the Sonangol transaction within our previously guided timeline. We now look forward to working with the partnership to enhance production and reserves to a level that reflects the potential of this very material asset,” added McDade.

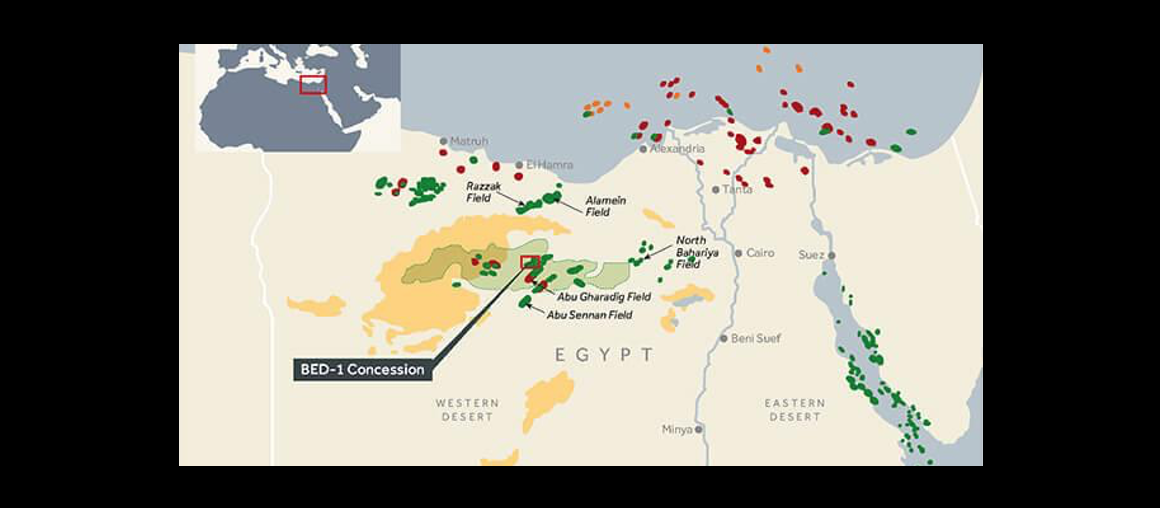

TAG Oil achieves first oil production in the Badr oil field, Egypt

TAG Oil has announced the successful re-entry of the vertical well, BED 1-7, at the Badr Oil Field (‘BED-1’) in the Western Desert, Egypt. The Company perforated the Abu Roash ‘F’ formation (‘ARF Formation’) and conducted a Diagnostic Fracture Injectivity Test (DFIT). The reservoir was further fracture stimulated with a large 110 tons sand treatment and pump schedule with positive response confirming reservoir models and projected performance.

On flowback, the well unloaded to surface under natural flow and cleaned up approximately 40% of the injected fracture fluid with significant presence of 230 API oil. Net cumulative oil produced during the short flowback was in excess of 500 barrels, which was connected to a flow-line to the BED-1 field’s production facilities and onward into a sales pipeline.

The well was shut-in to remove the frac string, install 3.5” production tubing string and down-hole Electric Submersible Pump (ESP) to achieve steady production at stabilized oil rates. The well is expected to be on production within the next few days and the Company expects to announce 30-day rates from the well in mid June.

Data collected from the well along with geomechanical and 3D seismic review has enhanced our horizontal well design. Plans are underway to secure a drilling rig to drill the first horizontal well designed with a multi-stage fracture stimulation. All necessary permits have been secured and site construction is underway. The well is expected to spud next month.

Toby Pierce, CEO of TAG Oil, commented: ‘This activity is the first step to establish oil production from the ARF Formation, an oil rich source rock that covers a significant portion of the 107 Sq. Km. BED-1 concession. Production results confirm the economic feasibility of this important resource play in the Western Desert of Egypt.’

Click here for Badr-1 (“BED-1”) concession area technical info

MIDAS SHARE TIPS: Focus on cleaner fossil fuel in Africa with Afentra

Fossil fuel firms are besieged by critics but perhaps the loudest opposition is reserved for Africa-focused businesses.

Eco-warriors argue that oil and gas exploration and production is exploitation by another name and that any company worth its salt should stop what it is doing – and fast. Paul McDade takes a different view. Formerly chief executive of FTSE 100 Tullow Oil, McDade has spent 35 years in the oil and gas industry, including almost two decades in Africa.

He understands the continent and the role that energy plays in helping Africans improve their lot. That is why he established Afentra – a short form for ‘African energy transition’.

McDade’s mission is to buy oil and gas assets that are already in production, make them as safe and environmentally efficient as possible and employ local people to their benefit and the company’s.

Afentra shares are 25p and should increase substantially, as McDade puts his strategy into effect. shares are 25p and should increase substantially, as McDade puts his strategy into effect.

Early signs are encouraging. Afentra was formed through a quasi-takeover of Sterling Energy, a small energy firm in need of a change of direction. In the spring of 2021, McDade was parachuted in to deliver that change.

Within months, he and his team had found a deal – 20 per cent of a world-leading oil field just off the coast of Angola.

The state-owned energy group, Sonangol, wanted to reduce its 50 per cent stake in the field, known as Block 3/05 – Afentra was keen to buy. Like almost everything in Africa, the transaction has taken longer than expected. Finally signed off last April, the deal has been delayed ever since.

In the meantime, McDade acquired another 4 per cent of the Block from INA, a state-backed Croatian energy firm. Now, finally, the end is in sight.

The INA sale should complete within days, Sonangol is expected to follow suit in June and Afentra will then start to make money. Block 3/05 produces almost 20,000 barrels of oil a day so Afentra’s position will amount to around 5,000 barrels a day.

Under the terms of the Sonangol and INA deals, however, Afentra is entitled to oil accrued since a particular date in their negotiations – counter-intuitively, September 2021 for INA and April 2022 for Sonangol.

The agreements mean that McDade will end up paying out considerably less in upfront cash than he would have done had the deals completed straightaway. And he has had ample time to plan how to boost production from the Block.

Up to 30,000 barrels a day is in Afentra’s sights, through modern extraction techniques and more proactive management.

There are also clear opportunities to make the Block environmentally cleaner, including a reduction in gas flaring, which sends greenhouse gases shooting into the atmosphere.

McDade and his crew are looking for other transactions too, several are in the pipeline and the hope is to achieve daily production running into tens of thousands of barrels in years to come. Crucially though, Afentra is focused on mature assets, fields that are already operating but could do better and become cleaner.

Brokers expect sales of around $60 million (£48 million) this year, rising to almost $100 million in 2024. Profits of some $22 million are forecast for 2023, with further growth pencilled in for next year.

Midas verdict: Fossil fuels pollute the planet so consumers and businesses alike need to shift towards renewable power. But the transition will take time and needs to be handled with sensitivity. McDade is determined to do just that at Afentra, delivering benefits for shareholders, customers and African communities. At 25p, the shares are a buy.

iMbokodo’s transformative vision for oil and gas in South Africa

Meridian Capital Limited, invests in companies and people with a successful track record from various sectors. As a part of the investment portfolio, the Company seeks to invest in early-stage oil and gas exploration companies with quality management teams and assets. One such investment is in iMbokodo Exploration and Production. A South African company with a difference – a majority black female management team led by the newly appointed Chair, Sonja De Bruyn.

Over the last four years, much has happened behind the scenes at iMbokodo, the majority women-led and majority black-owned South African oil and gas group. iMbokodo, from the Zulu word meaning ‘solid rock’, is recognised for its concrete approach that aims to have a positive impact in South Africa and works to build trusted partnerships with reputable IOC’s that believe in sharing the value of oil and gas assets in South Africa and developing a sustainable model that also creates value for the local community.

The Company’s geographic focus has largely aligned with the progress and development of the broader sub-Saharan Africa oil and gas sector, which has been significantly reshaped over the last few years by several major discoveries offshore of both South Africa and Namibia.

It also coincides with the deepening energy crisis in South Africa, a crisis that will require a range of solutions to overcome, including a Just Energy Transition which is already underway. Right now, it has never felt more important to be part of the solution to South Africa’s energy crisis.

Since the Company’s inception in 2019, is has gained an interest in three highly prospective onshore assets in eastern South Africa. The economic potential of these properties is clear, neighboured by Rhino Resources, Kinetiko Energy and Renergen, whose assets also contains the highly sought-after commodity of helium.

iMbokodo has not only successfully grown and consolidated its position as a burgeoning African oil and gas player, but has also spearheaded female empowerment in one of the least gender-diverse sectors globally.

Sonja de Bruyn, Chairperson of iMbokodo, believes that she has best team in place to deliver meaningful and transformative value-creation in the sector. While it was founded as a female empowerment company, the Company has taken steps to reinforce its commitment to gender diversity with her recent appointment as Chairperson, alongside a team of experienced black women who are also currently occupying the lead geologist and chief financial officer roles.

Sonja’s experience of over 25 years in investment and finance, as executive director at WDB Investment Holdings leading several of their acquisitions, as a co-founder of women-owned and managed investment firm Identity Partners, and also at Ethos Private Equity, where she was responsible for diversity and transformation; has shown her how important building a diverse team is for effecting outcomes. This is at the heart of the Company’s mission and why they believe in what is being built at iMbokodo.

At iMbokodo there is a responsibility to the people and communities where oil and gas operations take place. The Company aims to ensure all their participation has a growth and development focus beneficial to local communities with 10% of iMbokodo’s future share ownership structure allocated to the historically disadvantaged communities, to enable them to achieve their full potential in participation in the oil and gas arena.

The whole team’s expertise will enable iMbokodo to not only secure the appropriate financing required but also to unlock the most prospective investment opportunities. The Company recently secured a funding facility of US$12 million from Meridian Capital Limited, a significant global investor in various offshore and onshore oil and gas opportunities, highlighting the confidence that exists in the business, whilst simultaneously providing the firm capital required to enter a highly prospective asset on the West Coast of South Africa.

iMbokodo’s vision is to become the leading upstream company offering services to the oil and gas sector, impacting not just the businesses they work with, but with the intention to create meaningful and transformative partnerships with the local communities and becoming the BEE partner of choice for the South African / African oil and gas industry.

Level 37, 41 Heung Yip Road,

Wong Chuk Hang,

Hong Kong

Tel: +852 2239 5300

https://meridiancapitallimited.com/

Meridian Capital Limited is an international investment firm headquartered in Hong Kong with a diversified investment portfolio spanning consumer goods, real estate, hospitality and natural resources. Meridian Capital Limited seeks out global investment opportunities with favourable long-term fundamentals. They operate in emerging and frontier markets, often in partnership with industry leaders and talented entrepreneurs. Meridian Capital Limited carefully select their investments to ensure that they have a broader social, developmental or environmental impact in their sector and operating environment.

iMbokodo Exploration shuffles leadership, eyes expansion

Sean Lunn is heading out from his role as iMbokodo Exploration and Production chairman, handing the reins over to financial hotshot Sonja De Bruyn as the company prepares to sign up new acreage.

Lunn remains involved with iMbokodo, De Bruyn said, as the company works on two onshore projects and eyes further expansion.

Lunn will stay on the board and is a key shareholder and participant. “The restructuring reinforces our commitment to wanting women to go into spaces that are important to the economy,” De Bruyn said. The new chair comes from 25 years of work, primarily in the financial services sector.

“Most of my career has been about gender equity and black empowerment in South Africa … that transformation is very important and particularly in sectors where there are large investments,” she continued.

Funding

Access to financing will be essential for iMbokodo to grow. The company secured funding from Meridian Capital in March 2021.

“It is a challenge attracting investments to South Africa, but it’s about speaking to the right audience of investors and demonstrating the underlying assets and their quality,” De Bruyn said. The company is in talks with development finance institutions (DFIs) for support.

Qualifying as a black economic empowerment (BEE) company, iMbokodo will further benefit from the extent of its female management team.

The founding idea behind iMbokodo was about creating a woman-led company. Other top executives at the company include CFO Daphne Mentor and lead geologist Sanelisiwe Mhlambi.

These DFIs have an “opportunity to demonstrate that they back gender participation and parity”, De Bruyn said. “It will be up to us to demonstrate an ability to bring projects online and to find the right capital providers. Traditional private equity providers have a limited timeframe,” but there are other options.

“There’s a lot of excitement around some of the properties in South Africa and Namibia that should mean we can attract investors from all over the world,” she continued.

Exploration

iMbokodo has signed up two technical co-operation permits (TCPs), one in Free State, the other in Mpumalanga. The licence in Free State is close to Renergen assets, which recently started producing.

The licences are still in the early stages, De Bruyn said, suggesting the company was also in talks for another area. There is one new opportunity “in particular which is taking up a lot of our time”, De Bruyn said. “The offshore asset we are looking at is on trend with Venus and Graff, part of that basin.”

Lunn, the outgoing chairman, served as Impact Oil and Gas’ country manager, and is also a shareholder and director in Sezigyn and Ricocure.

Should the company be successful at its two existing TCPs, it could move products to market either via Renergen infrastructure or a pipeline running to Secunda.

“We still require partners,” De Bruyn explained, to bring in technical and financial capability. iMbokodo sees its part in working with local communities for approval.

“It’s exciting for us to bring onshore assets to market,” she said. “We can be part of the solution around gas-to-power. South Africa is in the middle of a power crisis and we must be mindful of the just energy transition – and we can play a role in that,” she said.

Policy challenges

As recent offshore seismic projects have demonstrated, it can be challenging to carry out projects in South Africa, despite the need for more power.

“The challenges are not intractable. There’s concerted focus now from the new minister of electricity, the new CEO of Eskom, the Department of Public Enterprises, that should complete the suite of government view. There’s a willingness and an acceptance, ideologically, that it can’t be solved without private sector participation,” the chair said.

New legislation in the upstream is coming. A number of public hearings have been held recently on the Upstream Petroleum Resources Development Bill.

De Bruyn said iMbokodo had been set up with an eye on the draft bill and that the company was “compliant with government expectations”.

One area where iMbokodo has an advantage is in its plans to work with local communities. This has to go beyond simply reserving a 10% stake, De Bruyn said, “it’s about that extra effort”.

There is scope to link up local SMEs with funding sources, so these communities can become involved in the supply chain. The iMbokodo chair cited progress in the mining sector to bring in local communities and ensure benefit sharing, and from renewable energy producers.

Afentra COO Ian Cloke to Discuss Sustainable Hydrocarbon Development at AOG 2022

Afentra acquires stake in two blocks offshore Angola. Afentra expects to sell its first cargo of crude oil in the third quarter of this year.

British oil and gas company Afentra has concluded the acquisition of a 4% stake in two blocks offshore Angola from Croatia’s INA-Industrija Nafte.

The acquisition in Block 3/05 and Block 3/05A marks Afentra’s foray into the Angola oil and gas space.

In April, Block 3/05’s gross output averaged 19,000 barrels of oil per day.

Afentra noted that its working interest in Block 3/05A would increase from 4% to 5.33%, subject to final approval of the allocation of the China Sonangol International interest to the remaining joint venture partners.

The deal, which was first announced in July 2022, received the nod from Angola’s Ministry of Mineral Resources, Oil and Gas in January 2023.

Afentra CEO Paul McDade said: “The indicative transaction metrics upon sale of crude inventories speak to the competitiveness with which we have been able to structure this deal and we are pleased to mark the inception of our partnership with Sonangol in Blocks 3/05 and 3/05A.

“It is also highly encouraging that the terms for the Block 3/05 licence extension award have been agreed; this represents a major step towards completion of the Sonangol transaction within our previously guided timeline.”

The deal, according to the British company, results in a net upfront consideration of $17m, which is mitigated by the company inheriting crude oil stock with a value of around $16.6m at $80 per barrel.

Additionally, the company has set aside $10m as a “escrow deposit at completion” that will be paid to INA following the formal completion of the Block 3/05 licence extension.

Afentra also noted that it expects to sell its first cargo of crude oil in the third quarter of this year.

PetroTal Announcement | Q3 2022 Operations Update

Press Release

PetroTal Corp. (TSXV: TAL) (AIM: PTAL) (OTCQX: PTALF) (“PetroTal” or the “Company“) issued the following operational and corporate updates for Q3 2022 Production.

Q3 2022 Production

PetroTal’s Q3 oil production was approximately 1.12 million barrels, representing 12,229 barrels of oil per day (“bopd”), which was the Company’s second best producing quarter to date. The current technical production capacity of the Bretana oilfield is approximately 18,000 bopd, prior to the upcoming completion of well 13H. The third quarter is a seasonally dry quarter, but this year the river water levels were unusually low, so PetroTal took the precaution of loading barges to a reduced capacity to ensure their safe operation while traveling. As a result, production was constrained during this period to match reduced export capacity, which has been impacted from the continued closure of the Northern Peruvian Pipeline (“ONP”). As the dry period passes and water levels rise, the Company expects to return to increased levels of barge capacity.

Well 13H Update

On October 4, 2022, well 13H reached its total depth and is now being completed. At an unconstrained level, the Company expects to again have production capacity of over 20,000 bopd that can be quickly activated once river levels normalize, and additional barges are made available.

Manuel Pablo Zuniga-Pflucker, President and Chief Executive Officer, commented:

“We continue to work with our trader to increase their overall available contracted barging fleet size to alleviate oil export constraints, which have been compounded by the unavailability of the ONP since early 2022. We are adjusting our 2022 guidance to reflect a conservative sales scenario, which we hope to exceed should the ONP become a viable sales option in Q4 2022. Under this conservative scenario, cash flow is still very strong allowing the Company to deliver on its promised shareholder return program in 2023. Additionally, we are looking forward to finalizing the ongoing successful working table discussions related to the social trust.”

ABOUT PETROTAL

PetroTal is a publicly traded, tri quoted (TSXV: TAL) (AIM: PTAL) and (OTCQX: PTALF) oil and gas development and production Company domiciled in Calgary, Alberta, focused on the development of oil assets in Peru. PetroTal’s flagship asset is its 100% working interest in Bretana oil field in Peru’s Block 95 where oil production was initiated in June 2018. In early 2020, PetroTal became the largest crude oil producer in Peru. The Company’s management team has significant experience in developing and exploring for oil in Peru and is led by a Board of Directors that is focused on safely and cost effectively developing the Bretana oil field. It is actively building new initiatives to champion community sensitive energy production, benefiting all stakeholders.

For the full release, visit: http://www.petrotal-corp.com/

TAG Oil signs petroleum services agreement to commence development operations at Abu Roash

Press Release

TAG Oil Ltd. (“TAG Oil” or the “Company”, TSXV: TAO and OTCQX: TAOIF) is pleased to announce that it has now formally entered into the previously announced petroleum services agreement (the “PSA”) with Badr Petroleum Company (“BPCO”) to commence development operations at the unconventional Abu Roash “F” reservoir in the Badr Oil Field (“BED-1”), a 107 km2 (26,000 acres) concession located in the Western Desert of Egypt.

The official PSA signing took place at the Egyptian General Petroleum Corporation (“EGPC”) offices in Cairo, Egypt, between Eng. Ibrahim Massoud, Chairman of BPCO, and Abby Badwi, Executive Chairman of TAG Oil, and present for the signing was Eng. Mohamed Baydoon, Vice President Production of EGPC.

Abdel Fattah (“Abby”) Badwi, Executive Chairman of TAG Oil said, “With the recently announced upsized C$22 million underwritten public offering and current working capital, the Company is well positioned to initiate development operations at the BED-1 Field and execute a significant capital program starting this year and continuing into 2023 to unlock the potential of this significant oil resource.”

Further details of the project are included in a presentation available on the Company’s website.

About TAG Oil Ltd.

TAG Oil is a Canadian based international oil and gas exploration company with a focus on opportunities in the Middle East and North Africa.

For more infomation, visit TAG Oil’s website: http://www.tagoil.com/

Support Africa in determining its own energy future

AIEN’s International Energy Summit

Africa should be supported in determining its own energy future, delegates at the AIEN’s International Energy Summit in London heard

A lively panel session moderated by Shakwa Nyambe, founder and managing partner of SNC Incorporated, discussed Africa’s energy future, the impact from events in Europe, and the international investment outlook. Participants encouraged a balanced and pragmatic approach to the energy transition in Africa, where 600mn people lack access to electricity and energy poverty is a critical issue.

See the full article here.

FEATURED IN

Afentra announces its half year results

Press Release

Afentra plc (‘Afentra’ or the ‘Company’), the upstream oil and gas company focused on acquiring mature production and development assets in Africa, announces its half year results for the six months ended 30 June 2022 (the ‘Period’).

Financial Summary

· Cash resources as at 30 June 2022 of $27.1 million (30 June 2021 of $40.8 million)

· Additional restricted funds of $8.0 million1

· Adjusted EBITDAX loss of $1.2 million (1H 2021: loss $1.5 million)

· Loss after tax of $2.9 million (1H 2021: loss $2.4 million)

· The Group remains debt free and fully carried for Odewayne operations

Angolan Acquisitions

The Company announced two strategically consistent and complementary transactions in Angola, signing sale and purchase agreements (‘SPAs’) with completion expected in Q4 2022 (together the ‘Acquisitions’):

· Sonangol Acquisition: acquisition of interests in Block 3/05 (20%) and Block 23 (40%) offshore Angola for a firm consideration of $80.5 million and contingent payments of up to $50 million;

· INA Acquisition: acquisition of interests in Block 3/05 (4%) and Block 3/05A (5.33%)2 offshore Angola for a firm consideration of $12 million and contingent payments of up to $21 million;3

· Financing Agreements: Sonangol and INA Acquisitions will be financed through cash on the balance sheet and agreed RBL and revolving working capital facilities with Trafigura:

o 5-year RBL facility with up to $75 million available to finance the Acquisitions (8% margin over 3-month secured overnight financing rate (the ‘SOFR’)) (the ‘Acquisition Facility’);

o Revolving working capital facility for up to $30 million to finance asset funding requirements between crude offtakes (4.75% over 1-month SOFR) (the ‘Working Capital Facility’).

· Offtake Agreement: The Company has also entered into an offtake agreement with Trafigura for Afentra’s crude oil entitlement lifted from the Acquisitions.4

AIM Re-admission Process

· AIM Admission Document was published on 10 August 2022. Suspension of the trading in the Company’s shares was lifted and trading in the Company’s ordinary shares recommenced

· General Meeting: Resolution to approve the Sonangol Acquisition was passed at the General Meeting held on 30 August 2022

· Completion of the Acquisitions and re-admission of the enlarged group to trading on AIM is anticipated in Q4 2022

Operations Summary

Operations pursuant to the ongoing Acquisitions

· Block 3/05: Congo basin, Angola (24% interest)5 – net 2P reserves of 27.7 mmbo, net 1H 2022 production of c. 4,700 bbl/day, net 2C resources of 10 mmbo with significant potential for future upgrades

· Block 3/05A: Congo basin, Angola (5.33% interest)2,5 – three appraised discoveries in adjacent licence to Block 3/05, providing tie-back opportunities using existing infrastructure; net 2C resource of 1.8 mmbo

· Block 23: Kwanza basin, Angola (40% interest)5 – highly prospective deepwater exploration and appraisal opportunity that is largely under-explored containing a small pre-salt oil discovery

Existing operations

· Odewayne exploration block: offshore Somaliland (34% interest fully carried by operator, Genel Energy) – the team continues its technical assessment and outlook on block prospectivity in discussion with the operator

Paul McDade, Chief Executive Officer, Afentra plc commented: “The first half of 2022 marked a transformational period for the Company, including the foundational asset transaction with Sonangol enabling entry into Block 3/05 in Angola. Following Period end, Afentra announced an incremental transaction with INA gaining additional exposure to the high quality 3/05 block and the adjacent 3/05A block. Combined, these complementary acquisitions provide a strong growth platform, underpinned by robust cash flow and significant potential to deliver upside value. The financing and offtake agreements announced with Trafigura demonstrate our ability to efficiently fund our focussed buy and build strategy. In August, we were pleased to recommence trading in Afentra’s shares on AIM and, subsequently, shareholder approval of the Sonangol transaction. We take confidence that the completion of a smooth election process and the re-instatement of the government will allow the Company to re-engage with the Government to achieve completion of the transactions in Q4 2022. Meanwhile, the Company continues to remain highly active and disciplined in its assessment of the opportunity landscape in line with its stated growth strategy.”

For the full release, see here: IR Solutions, Q4 Europe

FAR Ltd announces its results for the half-year ended 30 June 2022

Press Release

FAR Ltd is pleased to announce it has published its finacial report for the half-year ended 30 June 2022.

For the report, please see here: Half-Yearly-Report-and-Accounts.pdf (irmau.com)

Afentra CEO’s, Paul McDade, career is a far cry from Glasgow roots – upstream

Iain Esau – upstream

Afentra chief executive talks success, relationships, being held hostage and the energy transition

Glasgow-born Paul McDade, the 58-year-old chief executive of Africa-focused Afentra, is clear what makes for a successful business – people of a like mind with complimentary skills.

“Surround yourself with a great team of people that you get along with, have fun doing what you do and, if you’re ambitious and have a clear view of where you want to get to, you’ll get there as long as you persevere.”

He also highlights the importance of “relationships, managing your reputation and leaving things in a good place – you never know when you might have to pick things up again.”

See the full article here.

See more about Afentra here.

FEATURED IN

TAG Oil announces its Q1 2023 results

Press Release

TAG Oil Ltd. (“TAG Oil” or the “Company”, TSXV: TAO and OTCQX: TAOIF) is pleased to report the filing of its financial results for the interim period ending June 30, 2022. A copy of TAG Oil’s financial statements and management discussion and analysis for the interim period ending June 30, 2022 are available on SEDAR (www.sedar.com) and on the Company’s website (https://tagoil.com/investors/financial-reports/).

Highlights over the period include that the Company had C$13.1 million (March 31, 2022: C$13.3 million) in cash and cash equivalents and C$15.4 million (March 31, 2022: C$15.4 million) in working capital and has no debt. TAG Oil continues to manage its costs and allocate the necessary resources towards its business development efforts in Egypt and other areas in the Middle East and North Africa region.

TAG Oil is continuing to make significant progress on a few key strategic opportunities in Egypt, as previously announced. TAG Oil expects to have an update on the status of one or more of these transactions in due course.

About TAG Oil Ltd.

TAG Oil is a Canadian based international oil and gas exploration company with a focus on opportunities in the Middle East and North Africa.

For more infomation, visit TAG Oil’s website: http://www.tagoil.com/

FAR Ltd takes 100% ownership in The Gambia Blocks A2 and A5

Press Release

FAR Ltd (“FAR” or the “Company”) is pleased to announce that its wholly owned subsidiary FAR Gambia Ltd has recently acquired an additional 50% interest in Blocks A2 and A5 offshore The Republic of The Gambia, giving FAR a 100% working interest. The interest was acquired from PC Gambia Ltd a subsidiary of Petroliam Nasional Berhad (“PETRONAS”).

Highlights

· FAR has acquired a further 50% interest in Gambia Blocks A2 and A5 giving the Company a 100% working interest

· Commitment to drill an exploration well during the next two-year contract term removed

· FAR has initiated a process to find partners to fund the forward exploration programme

· New laboratory analysis has positive implications for the Panthera Prospect directly up-dip of Bambo-1.

The next two-year license term for Blocks A2 and A5 is due to commence on 1 October 2022 and as part of the acquisition, FAR has negotiated with the Government of The Gambia to remove the obligation to drill an exploration well during this term. The removal of the commitment to drill an exploration well results in a significant reduction in expenditure and allows for a detailed geoscience review incorporating the results of the recent Samo-1 and Bambo-1 wells to ensure future exploration wells are located optimally.

The Company has opened a data room forsuitably qualified parties to consider participation in a Joint Venture to undertake the geoscience review and ultimately to drill additional exploration wells. FAR expects new partners to fund the costs of the work programme. Subject to the satisfaction of certain conditions, including Government approval, incoming participants in the Joint Venture may assume Operatorship.

The 100% interest in Blocks A2 and A5 and the revised investment obligation enhances FAR’s ability to seek farm-in partners to the project while controlling any potential corporate action and process.

Commenting on the update, FAR Chairman Patrick O’Connor said: “FAR’s acquisition of the remaining 50% of The Gambia assets and the positive discussions with the Government of The Gambia on the terms for the First Extension Exploration Period will provide FAR options to utilise its valuable exploration data to maximise value from the asset. These developments have minimal impact on FAR’s forward budget while significantly improving the chance of securing new investment.

FAR remains committed to generating real value for our shareholders, and we see this transaction as a part of that overarching strategy.”

For the full press release, see here: https://far.live.irmau.com/irm/pdf/190a9491-46ed-46a3-bedf-4696334b0b51/FAR-takes-100-ownership-in-The-Gambia-Blocks-A2-and-A5.pdf

PetroTal announces its Q2 2022 financial and operating results

Press Release

PetroTal Corp. (TSXV: TAL) (AIM: PTAL) (OTCQX: PTALF) (“PetroTal” or the “Company“) is pleased to announce its financial and operating results for the three months ended June 30, 2022 (“Q2 2022”).

Selected financial and operational information is outlined below and should be read in conjunction with the Company’s unaudited consolidated financial statements (“Financial Statements”), and management’s discussion and analysis (“MD&A”) for the three and six months ended June 30, 2022, which are available on SEDAR at www.sedar.com and on the Company’s website at www.PetroTal‐Corp.com. All amounts herein are in United States dollars (“USD”) unless otherwise stated.

PetroTal delivered solid Q2 2022 financial and operational performance highlighted by record production rates, record cash flow, and a robust balance sheet profile with a substantial net cash position.

Q2 2022 Highlights

-

Achieved record quarterly production of 14,467 barrels of oil per day (“bopd”) and quarterly sales of 14,616 bopd, up 25% and down 5%, respectively, from Q1 2022, representing the Company’s seventh straight quarter of production growth, with unencumbered sales for the majority of the quarter;

-

Completed well 11H on June 30, 2022, which produced over 300,000 barrels of oil over its first 30 full days on production, has paid out its capital investment, and averaged over 9,000 bopd from August 1 to 22, 2022;

-

Achieved a new daily Company production record of 25,218 bopd on July 1, 2022 with production briefly reaching 26,000 bopd, representing the maximum capacity at the newly expanded Central Processing Facility (“CPF-2”);

-

Sold approximately 86% of sales through the Brazilian route with the remaining 14% sold to the Iquitos Refinery while the Northern Peruvian Oil Pipeline (“ONP”) was offline, successfully redirecting 456,000 barrels from the ONP to the Brazilian market;

-

Significantly reduced transportation costs through significantly reduced diluent blending requirements to Brazil, contributing to record low transportation costs of $3.4 million ($2.54/bbl);

-

Generated record net operating income (“NOI”) and EBITDA(a) of $98.6 million and $93.4 million, respectively, both up three and a half fold from Q2 2021 levels and almost double from Q1 2022;

-

Generated record free cash flow(a) of $69.4 million before changes in non-cash working capital and debt service, accumulating over $100 million, for the six months ended June 30, 2022;

-

Invested approximately $24.0 million in capital expenditures (“Capex”), lower than revised guidance by $5 million, due to drilling delays from the March 2022 social protests. Approximately two thirds of Capex spent was for drilling and completion related investments with the remainder divided amongst smaller production operation projects;

-

On April 1, 2022, the Company paid $20 million of principal to bondholders through the 101% call option mechanism set out in the bond agreement. As of June 30, 2022 and August 25, 2022, the Company is in compliance with all covenants; with $80 million of bond principal remaining; and,

-

Exited the quarter with $77 million of total cash, including $13.5 million of restricted cash, and approximately ($79) million in net debt/(surplus)(1), a record level for the Company allowing for a future return of capital program in Q4 2022 or Q1 2023, with an extremely solid balance sheet profile.

(1) Net debt/(surplus) defined as cash and restricted cash + VAT receivable (short and long term) + trade receivables + short term and long term derivative assets – AP – short and long term leases – short and long term debt – derivative obligation

Selected Financial and Operational Highlights

| Three Months Ended | Six Months Ended | ||||||||||||

| (in thousands USD) | June 30, 2022 | June 30, 2021 | June 30, 2022 | June 30, 2021 | |||||||||

| Financial | |||||||||||||

| Crude oil revenues | 118,435 | 42,809 | 211,187 | 75,165 | |||||||||

| Royalties | (8,104 | ) | (2,306 | ) | (14,477 | ) | (4,054 | ) | |||||

| Net operating income (1) | 98,589 | 29,677 | 162,783 | 49,647 | |||||||||

| Commodity price derivative (gain)/loss | (6,533 | ) | 4,147 | (27,546 | ) | (18,365 | ) | ||||||

| Net income | 84,249 | 11,373 | 148,759 | 42,159 | |||||||||

| Diluted net income (US$/share) | 0.10 | 0.01 | 0.18 | 0.05 | |||||||||

| Capital expenditures | 24,024 | 22,363 | 41,553 | 29,476 | |||||||||

| Operating | |||||||||||||

| Average production (bopd) | 14,467 | 8,839 | 13,114 | 8,089 | |||||||||

| Average sales (bopd) | 14,616 | 8,842 | 15,065 | 8,711 | |||||||||

| Average Brent price ($/bbl) | 111.80 | 69.01 | 101.54 | 64.28 | |||||||||

| Contracted sales price, gross ($/bbl) | 111.39 | 66.55 | 99.42 | 62.79 | |||||||||

| Netback ($/bbl)(2) | 74.13 | 36.88 | 59.70 | 31.49 | |||||||||

| Funds flow provided by operations(2) | 60,688 | 19,627 | 66,432 | 24,094 | |||||||||

| Balance sheet | |||||||||||||

| Cash and restricted cash | 77,017 | 79,491 | |||||||||||

| Working capital | 141,971 | 62,634 | |||||||||||

| Total assets | 535,202 | 359,788 | |||||||||||

| Current liabilities | 92,988 | 72,639 | |||||||||||

| Equity | 357,732 | 180,291 | |||||||||||

1. Net operating income and Netback represent revenues less royalties, operating expenses, and direct transportation.

2. Netback per barrel (“bbl”) and funds flow provided by operations do not have standardized meaning prescribed by GAAP and therefore may not be comparable with the calculation of similar measures for other entities. See “Selected Financial Measures” section.

Q2 2022 Financial Results

Record revenue. Oil revenue was $118.4 million ($89.04/bbl) compared to Q2 2021 of $42.8 million ($53.20/bbl) and Q1 2022 of $92.7 million ($66.41/bbl).

Record net operating income. Generated record NOI and EBITDA(a) of $98.6 million ($74.13/bbl) and $93.4 million ($70.26/bbl), respectively, compared to $29.7 million ($36.88/bbl) and $26.4 million ($32.87/bbl), respectively, in Q2 2021 and $64.2 million ($45.96/bbl) and $58.7 million ($42.58/bbl), respectively, in Q1 2022.

Capital investment. Capital expenditures in the quarter totalled $24.0 million and were focused on drilling and completing well 11H and advancing infrastructure projects. The total represented approximately 88% of the budget, due to deferral of drilling activity as a result of the social protest activity in March 2022, and deferral of additional facility and water disposal work until 2023. First half 2022 capital expenditures are $41.6 million, trending well under the $70.0 million approved budget.

Record Q2 and YTD 2022 free cash flow. Generated record free cash flow(a) before changes in non-cash working capital and debt service of $69.4 million. Total free cash flow for the six months ended June 30, 2022 has surpassed $100 million, significantly boosting the Company’s liquidity profile.

Lower operating costs. Total quarterly lifting costs were $8.4 million ($6.28/bbl), a decrease from Q1 2022 of $10.1 million ($7.20/bbl) and from Q2 2021 of $5.5 million ($6.84/bbl), driven by lower contracted operations and COVID 19 expenses.

Record low transportation costs. Diluent and barging costs were $3.4 million ($2.54/bbl) in the quarter, reduced significantly from $12.1 million ($8.68/bbl) in Q2 2022, and down from $5.3 million ($6.61/bbl) in Q2 2021. The decrease was supported by lower barging standby time, and significantly lower diluent and diesel costs from shipping through the Brazil and Iquitos routes instead of incurring ONP costs.

G&A on budget. Q2 2022 G&A was $5.1 million ($3.87/bbl) compared to $4.7 million ($3.38/bbl) in Q1 2022 and $3.2 million ($4.01/bbl) in Q2 2021 representing a 15% and 3% increase and decrease, respectively, on a per barrel basis.

Record net income. Net income was $84.2 million an increase of 31% over Q1 2022 of $64.5 million and significantly exceeding $11.4 million in Q2 2021.

Balance sheet reflects a record net debt/(surplus) position. Net debt/(surplus) was approximately ($79) million as at June 30, 2022, as defined internally by the Company.

Large net derivative asset balance. The total net derivative asset on the balance sheet as at June 30, 2022 was $56.8 million, consisting mostly of the true up value of oil in the ONP. As at June 30, 2022 approximately 3.1 million barrels remained in the ONP backstopping the net derivative value with a much lower cost base from sales made in 2020 and 2021. With the ONP maintenance estimated to be completed in October 2022, and the pipeline operational again, the schedule to realize the derivative value has shifted primarily into 2023, which will further supplement the Company’s expected cash reserves.

Operational and Financial Highlights Subsequent to June 30, 2022

Bayovar Export Realized. As announced on June 16, 2022 and July 5, 2022, Petroperu delivered approximately 550,000 barrels through the ONP to Bayovar and exported nearly 720,000 barrels to an international refiner. The Company expects to receive $53.9 million from Petroperu, net of usual ONP fees and adjustments. Post this Bayovar export, the amount of oil remaining in the ONP dropped from 3.1 million barrels to approximately 2.4 million barrels.

Navigating barging challenges. During July, the Company encountered barging delays that were compounded by the closure of the ONP, resulting in production constraints that lowered the average production to 5,700 bopd from July 7 until July 25. The Company has secured approximately 420,000 barrels of export barging capacity for August 2022 plus 60,000 barrels for the Iquitos Refinery which has allowed production to increase to 19,000 bopd since August 22, 2022. PetroTal continues to explore long term solutions to ensure appropriate barging capacity is available to accommodate higher oil production rates and to optimize logistics and barging fleet size for our Brazilian route.

Drilling schedule adjustments. Due to well servicing and a conductor pipe placement for a future well, the Company’s revised drilling plan now schedules drilling the 13H well to be followed by the 12H well. The 13H was spud on August 24, 2022 and is estimated to be on production by late October.

Current liquidity update. Current total cash as at August 15, 2022 is approximately $115 million including $15 million in restricted cash and up to date payments from our Brazilian route shipping counterparty, but not including outstanding amounts owing from Petroperu.

Corporate Hedging Update. PetroTal recently sold a swap at $62.05/bbl and bought a call at $70.00/bbl on approximately 750,000 barrels of H2 2022 production. PetroTal will receive cash when the Brent oil price is above $70/bbl, and will have a floor price of $62.05/bbl. After this hedge, the Company is approximately 25% hedged on corporate production volumes in Q3 and Q4 2022. As 2022 progresses, the Company will look to layer in additional hedges for H1 2023 on up to 25% of total corporate production.

Ten million barrels produced. On August 22, 2022, the Company formally surpassed the ten million barrels of produced oil milestone in only four years.

Reiterating 2022 Guidance

The Company is reiterating guidance provided in May 2022 as navigated a number of logistical issues caused by the ONP shut down and barging fleet delays. The Company estimated 2022 average production to be between 15,000 bopd and 16,000 bopd and the latest production forecast confirms the lower end of this range. Thanks to higher oil prices and lower diluent costs, the Company maintains EBITDA to be approximately $340 million and associated free cash flow before working capital and debt service to be approximately $230 million. The reiterated guidance is highly dependent on certain sales route availability assumptions, ONP maintenance completion schedules, and Petroperu’s unencumbered access to credit, which if different from current estimates could materially alter the reiterated guidance.

As a result of the revised drilling schedule, the Company is guiding 15,000 bopd, and has adjusted Q3 and Q4 2022 production profiles to the following levels as dictated by available sales scheduling:

| Adjusted Guidance | Q1 (actual) | Q2 (actual) | Q3 | Q4 | 2022 |

| Oil wells completed | 1 (10H) | 1 (11H) | 0 | 2 | 4 |

| Average Production (bopd) | 11,746 | 14,467 | 14,250 | 19,500 | 15,000 |

| CAPEX (millions) | $18 | $24 | $29 | $40 | $111 |

| USD millions | Guidance |

| Contracted Brent (USD/bbl) | $102 |

| Average Production (bopd) | 15,000 – 16,000 (25% downtime) |

| Net operating income | $351 |

| G&A | ($22) |

| Net derivative settlements(1) | $13 |

| Adjusted EBITDA1 | $342 |

| CAPEX | ($111) |

| Free cash flow | $231 |

(1) Approximately $33 million in anticipated 2022 true-up revenue has now been deferred into 2023 as a result of the ONP maintenance.

Updated Corporate Presentation, investor webcast and AGM reminder

PetroTal will host an investor webcast on August 25, 2022 at 9:00 am CT (3:00 pm BST), following release of the Q2 2022 results. The Company has also provided an updated corporate presentation inclusive of the Q2 2022 results, on its website. PetroTal’s 2021 AGM will be held virtually on September 15, 2022.

Link to PetroTal Q2 2022 webcast

https://stream.brrmedia.co.uk/broadcast/62e8f64f04182f363ba99aa2

Manuel Pablo Zuniga-Pflucker, President and Chief Executive Officer, commented,

“We would like to thank our entire team for another record quarter on many fronts. Though we have experienced recent production constraints from short term sales bottlenecks, unconstrained production run rates are over 20,000 bopd which we successfully tested in our facilities. The outlook for PetroTal’s low sulfur oil remains incredibly robust with recent strong export demand realized. We continue to meet commercial challenges head on and are excited about potential short- and long-term solutions for PetroTal’s river transportation options. From a social perspective, the 2.5% social fund working table sessions have been extremely productive, transparent, and aligned, creating the necessary stability our field has strived for over the years. Many milestones have yet to be achieved, however, the initiatives remain on track and functioning as planned with more formal updates on this to come in H2 2022. Finally, I would like to congratulate the entire PetroTal team on our recent milestone of ten million barrels produced in only four short years since first production.”

ABOUT PETROTAL

PetroTal is a publicly traded, tri quoted (TSXV: TAL) (AIM: PTAL) (OTCQX: PTALF) oil and gas development and production Company domiciled in Calgary, Alberta, focused on the development of oil assets in Peru. PetroTal’s flagship asset is its 100% working interest in Bretana oil field in Peru’s Block 95 where oil production was initiated in June 2018. In early 2020, PetroTal became the largest crude oil producer in Peru. The Company’s management team has significant experience in developing and exploring for oil in Peru and is led by a Board of Directors that is focused on safely and cost effectively developing the Bretana oil field. It is actively building new initiatives to champion community sensitive energy production, benefiting all stakeholders.

For the full release, visit: http://www.petrotal-corp.com/

PetroTal is commited to the preservation of biodversity through a forest restoration project – ProActivo

World Environment Day was celebrated last Sunday, a date to value the importance of caring for our planet and, therefore, of actions in favor of its sustainability. Faced with the latter, and as part of its Environmental Compensation Plan, PetroTal, a company led and operated by Peruvians, has been executing the Forest Restoration Program, which aims to recover the ecosystem of an Amazonian forest of 7.45 hectares, degraded by natural flooding in the area.

See the full article here.

See more about PetroTal here.

FEATURED IN

TAG Oil announces its FY2022 results

Press Release

TAG Oil Ltd. (“TAG Oil” or the “Company”, TSXV: TAO and OTCQX: TAOIF) is pleased to report the filing of its financial results for the fiscal year ending March 31, 2022. A copy of TAG Oil’s financial statements and management discussion and analysis for its most recently completed financial year are available on SEDAR (www.sedar.com) and on the Company’s website (https://tagoil.com/investors/financial-reports/).

Highlights over the period include that the Company had C$13.3 million (December 31, 2021: C$14.1 million) in cash and cash equivalents and C$15.4 million (December 31, 2021: C$15.8 million) in working capital and has no debt. TAG Oil continues to manage its costs and allocate the necessary resources towards its business development efforts in Egypt and other areas in the Middle East and North Africa region.

As previously announced, the Company is continuing to make significant progress on a few key strategic opportunities in Egypt. TAG Oil expects to have an update on the status of one or more of these transactions by the end of calendar Q3.

About TAG Oil Ltd.

TAG Oil is a Canadian based international oil and gas exploration company with a focus on opportunities in the Middle East and North Africa.

For more infomation, visit TAG Oil’s website: http://www.tagoil.com/

PetroTal provides sales update

Press Release

PetroTal Corp. (TSXV: TAL) (AIM: PTAL) (OTCQX: PTALF) (“PetroTal” or the “Company“) is pleased to announce the following sales related update.

720,000 barrels of oil under contract for export from Bayovar. Approximately 720,000 barrels of PetroTal’s Bretana oil has now been successfully tendered at the Bayovar port by Petroperu for the July lifting. Following an accelerated and temporary re-opening of section II of the Northern Peruvian Pipeline (“ONP”) which had been previously closed due to maintenance operations, Petroperu has been able to deliver a material amount of oil to Bayovar over recent weeks. This oil previously entered the ONP in 2020 and was part of the restructured oil sales arrangement with Petroperu, announced in late 2020, with the Company receiving approximately $45/bbl of value. PetroTal will receive the difference between this tender price and the restructured $45/bbl price in the contract, generating over $60 million of price adjustment revenue.

Section II of the ONP line temporarily online. Petroperu recently informed PetroTal that it was able to temporarily pump all the oil from Station 5 (approximately 550,000 barrels) to the Bayovar port. The ONP section II has an approximate capacity of 2.1 million barrels with an estimated 82% being Bretana oil. Section I of the line between pump stations 1 and 5 remains closed due a maintenance delay from ongoing social protests in one community near pump station 1.

Manuel Pablo Zuniga-Pflucker, President and Chief Executive Officer, commented

“We applaud Petroperu’s efforts to resume partial pipeline operations in a safe and reliable way. The true up revenue to be received from this tender was previously anticipated in Q4 2022 and will provide assurance that we can execute our shareholder strategy on time and as indicated in our corporate presentation.”

ABOUT PETROTAL

PetroTal is a publicly traded, tri quoted (TSXV: TAL) (AIM: PTAL) and (OTCQX: PTALF) oil and gas development and production Company domiciled in Calgary, Alberta, focused on the development of oil assets in Peru. PetroTal’s flagship asset is its 100% working interest in Bretana oil field in Peru’s Block 95 where oil production was initiated in June 2018. In early 2020, PetroTal became the largest crude oil producer in Peru. The Company’s management team has significant experience in developing and exploring for oil in Peru and is led by a Board of Directors that is focused on safely and cost effectively developing the Bretana oil field. It is actively building new initiatives to champion community sensitive energy production, benefiting all stakeholders.

For the full release, visit: http://www.petrotal-corp.com/

PetroTal is fuelling the success of Peru’s oil industry – Financial Post

The company is focused on the acquisition, development and exploration of material oil assets in Peru

PetroTal Corp. (TSXV:TAL) is an oil and gas development and production company domiciled in Calgary, Alta., focused on the development of oil assets in Peru. PetroTal’s flagship asset is its 100 per cent working interest in the Bretana oil field in Peru’s Block 95 where oil production was initiated in June 2018.

In early 2022, PetroTal Corp. became the largest crude oil producer in Peru and has been recognized by TSXV, which has named the company as one of the winners in this year’s TSX Venture 50.

See the full article here.

See more about PetroTal here.

FEATURED IN

Afentra enters Angolan upstream – Petroleum Economist

Simon Ferrie – Petroleum Economist

The UK independent has acquired stakes in two blocks from Sonangol

“We think of Angola’s upstream as similar to the North Sea around 15 years ago,” Paul McDade, CEO of London-listed independent Afentra, tells Petroleum Economist. McDade was speaking shortly after the company announced the signing of an SPA with Angolan state-owned Sonangol to purchase stakes in blocks 3/05 and 23. The company purchased its 20pc non-operating stake in block 3/05—which produces c.17,000bl/d and will continue to be operated by Sonangol—for an initial consideration of $80mn and a contingent payment of up to $50mn. Afentra’s net share of 2P reserves is around 20mn bl, while the asset’s breakeven price is $35/bl. The block is a “cash-generative asset”, emphasises McDade. Afentra’

See the full article here.

See more about Afentra here.

FEATURED IN

Lunn rewriting South Africa’s oil strategy- upstream

Ian Esau – upstream

The new bill going through parliament owes much to entrepreneur’s powers of persuasion and ability to thrive in “impossible” situations

Oil and gas entrepreneur Sean Lunn is determined to improve the socio-economic conditions of his native South Africa.

Despite legal challenges, he believes the nation’s hydrocarbon resources are “potentially so big and could make such a difference to our socio-economic environment, they cannot be ignored”.

A respected figure in southern African upstream circles, Durban-born Lunn and his wife Julie have their hands full with 10-year-old twin boys, also budding entrepreneurs it would seem.

After a decade or so in investment banking, 45-year-old Lunn sharpened his upstream acumen as Impact Oil & Gas’ country manager for South Africa and Namibia, and for seven years was also point man for the Offshore Petroleum Association of South Africa (Opasa) during its tough negotiations with government over upstream legislation.

See the full article here.

See more about FAR Ltd here.

FEATURED IN

Oil and gas entrepreneur Sean Lunn rewriting South Africa’s oil strategy

New bill going through parliament owes much to entrepreneur’s powers of persuasion and ability to thrive in “impossible” situations.

Despite legal challenges, he believes the nation’s hydrocarbon resources are “potentially so big and could make such a difference to our socio-economic environment, they cannot be ignored”.

A respected figure in southern African upstream circles, Durban-born Lunn and his wife Julie have their hands full with 10-year-old twin boys, also budding entrepreneurs it would seem.

After a decade or so in investment banking, 45-year-old Lunn sharpened his upstream acumen as Impact Oil & Gas’ country manager for South Africa and Namibia, and for seven years was also point man for the Offshore Petroleum Association of South Africa (Opasa) during its tough negotiations with government over upstream legislation.

Afentra makes Angola debut with $80 million offshore purchase – Energy Capital & Power

London-listed oil and gas independent Afentra has signed a sales and purchase agreement (SPA) with Angola’s national oil company, Sonangol, for stakes in two offshore blocks in the Lower Congo and Kwanza Basins. Marking the entry of the UK independent into the southern African country, the deal comprises an $80 million upfront payment for stakes in Block 3/05 and Block 23, offshore Angola.

As per the terms of the deal, in addition to the $80 million upfront cash commitment, Afentra could likely pay up to $50 million in contingent payments for Block 3/05 and $500.000 for Block 23. The SPA will see Afentra holding a 20% non-operated interest and a 40% non-operated interest in Block 3/05 and Block 23, respectively. Sonangol will remain the operator of Block 3/05 with a 30% interest while holding a non-operating stake in Block 23 at 20%.

See the full article here.

See more about Afentra here.

FEATURED IN

PetrolTal 2021 year-end financial and operating results

Press Release

PetroTal Corp. (TSXV: TAL) (AIM: PTAL) (OTCQX: PTALF) (“PetroTal” or the “Company“) is pleased to announce its financial and operating results for the year and three months (“Q4”) ended December 31, 2021.

Selected financial, reserves and operational information is outlined below and should be read in conjunction with the Company’s audited consolidated financial statements (“Financial Statements”), management’s discussion and analysis (“MD&A”) and annual information form (“AIF”) for the year ended December 31, 2021, which are available on SEDAR at www.sedar.com and on the Company’s website at www.PetroTal‐Corp.com. Reserve amounts presented herein were derived from an independent reserves report (the “NSAI Report”) prepared by Netherland, Sewell & Associates, Inc. (“NSAI”) effective December 31, 2021. All amounts herein are in United States dollars (“USD”) unless otherwise stated.

2021 Significant Milestones and Highlights

-

Achieved production of 8,966 barrels of oil per day (“bopd”) and sales of 8,449 bopd, up 58% and 48%, respectively, from 2020;

-

Recorded a 5th straight quarter of production growth; reaching 10,147 bopd in Q4 2021 from 9,508 bopd in Q3 2021;

-

Achieved a four year Company target of 20,000 bopd in mid December 2021 underpinned by strong production rates from the newly drilled 8H and 9H wells in late Q3 and Q4 2021 that each reached over 8,500 bopd, respectively;

-

Generated record net operating income (“NOI”) and EBITDA(a) in 2021 of $105 million and $90 million, up approximately 3.6x and 5x, respectively, from 2020;

-

Generated record funds flow provided by operations(a), before changes in working capital of $86.7 million, up over 5x from 2020;

-

Grew proved plus probable (“2P”) and proved plus probable plus possible (“3P”) reserves by 53% and 39%, respectively, to 78 and 147 million barrels of oil (“bbl”);

-

Material progression of 2P after tax net present value discounted at 10% (“NPV-10”) reserve value per share of $1.23, up 62% from 2020;

-

Generated 2021 proved (“1P”) and 2P reserve replacement ratios of 457% and 816%, respectively; and,

-

Created the framework for a social trust representing 2.5% of production, to create long standing alignment between communities and government, with a view to minimizing social downtime, maximizing social profitability, and developing community projects that will have a significant positive impact near the Company’s Bretana oilfield.

Selected Financial and Operational Highlights

| Three Months Ended | Twelve Months Ended | |||||||||||

| (in thousands USD) | Dec 31, 2021 | Sept 30, 2021 | Dec 31, 2021 | Dec 31, 2020 | ||||||||

| Financial | ||||||||||||

| Crude oil revenues | 39,243 | 44,781 | 159,189 | 76,593 | ||||||||

| Royalties | (2,304 | ) | (2,604 | ) | (8,962 | ) | (2,877 | ) | ||||

| Net operating income (1) | 25,726 | 29,587 | 104,960 | 28,881 | ||||||||

| Commodity price derivative (income)/loss | 5,622 | (293 | ) | (13,036 | ) | 4,788 | ||||||

| Net income (loss) | 6,843 | 14,970 | 63,972 | (1,524 | ) | |||||||

| Basic and diluted net income (loss) (US$/share) | 0.01 | 0.02 | 0.08 | (0.00 | ) | |||||||

| Capital expenditures | 26,601 | 26,114 | 82,191 | 42,297 | ||||||||

| Operating | ||||||||||||

| Average production (bopd) | 10,147 | 9,508 | 8,966 | 5,675 | ||||||||

| Average sales (bopd) | 7,242 | 9,142 | 8,449 | 5,700 | ||||||||

| Average Brent price ($/bbl) | 79.79 | 73.21 | 70.82 | 43.20 | ||||||||

| Contracted sales price, gross ($/bbl) | 77.46 | 71.06 | 68.22 | 43.02 | ||||||||

| Netback ($/bbl)(1) | 38.61 | 35.18 | 34.03 | 13.84 | ||||||||

| Funds flow provided by operations(2) | 34,714 | 18,648 | 77,456 | 13,341 | ||||||||

| Balance sheet | ||||||||||||

| Cash and restricted cash | 74,459 | 57,655 | 74,459 | 9,628 | ||||||||

| Working capital | 47,319 | 56,455 | 47,319 | (22,157 | ) | |||||||

| Total assets | 398,288 | 373,261 | 398,288 | 215,138 | ||||||||

| Current liabilities | 84,767 | 69,785 | 84,767 | 58,608 | ||||||||

| Equity | 204,257 | 195,572 | 204,257 | 137,163 | ||||||||

(1) Net operating income obtained from revenues less royalties, operating expenses, and direct transportation.

(2) Netback per barrel (“bbl”) and funds flow provided by operations do not have standardized meaning prescribed by GAAP and therefore may not be comparable with the calculation of similar measures for other entities. See “Selected Financial Measures” section.

2021 Operational highlights

-

Robust well results. Completed one deviated and two horizontal oil wells in 2021. Both horizontal wells had the longest laterals ever drilled in Peru with production rates in excess of 8,500 bopd during the first month, and both paying out in under two months. Well 7D, drilled as a deviated well in the spring of 2021, had rates in excess of 4,000 bopd and has produced over 0.5 million bbl in under one year.

-

Infrastructure achievements. Achieved significant infrastructure milestones in 2021 with the completion of all major construction work on CPF-2 and the completion and coring of an additional water disposal well, essentially doubling water disposal capacity to 100,000 barrels of water per day and allowing the field to produce up to 26,000 bopd of oil.

-

Material reserves increases. Delivered excellent 2021 reserve report upgrades with increases for 1P, 2P, and 3P reserves by 68%, 53%, and 39% to 37.4, 77.9 and 147.1 million barrels, respectively. In addition, PetroTal was able to decrease 2P Finding and Development Costs (“F&D”) by 6% to $4.68/bbl while adding seven 2P locations plus related infrastructure, leading to a record 2P after tax NPV-10 of just over $1 billion.

-

Expanded Brazilian sales. Created a highly successful third sales route to market into the Atlantic region through Brazil that has surpassed the Northern Peruvian Pipeline (“ONP”) as the Company’s second most profitable sales route. The first pilot cargo, completed in December 2020 was 106,000 barrels, and during 2021 PetroTal built a strong trusted commercial relationship that will allow Brazilian shipments of 400,000 barrel cargos (without the need for diluent blending), thereby providing a safe and stable offtake of nearly 14,000 bopd at attractive netbacks.

-

Social alignment mechanism established. In an effort to facilitate long standing alignment between the government and communities, PetroTal announced and submitted a proposal to the Peruvian Ministry of Energy and Mines for creation of a new social trust aimed to promote direct investments into the Loreto region. The fund will be based on 2.5% of crude oil production, payable over two week periods and calculated using the same methodology as Perupetro applies for royalties. The fund committee and investment legal entities are in the process of being created with full transparency and auditability to the public.

-

2021 capital program executed and optimized. PetroTal’s 2021 Capex investment totaled $82 million in 2021 compared to $42 million in 2020, which was significantly curtailed due to the COVID-19 pandemic.

2021 Financial highlights

-

Leverage to kickstart development. Successfully executed a $100 million senior secured bond issue at the trough of the oil price commodity price cycle with payment terms and amortization optimized to impact the Company in a much stronger oil macro backdrop, allowing PetroTal to commence its 2021 capital program in March 2021 with a sound liquidity injection.

-

Record net revenue. Delivered net revenue after differentials and royalties of $150 million ($48.70/bbl) compared to 2020 of $74 million ($35.58/bbl).

-

Record net operating income. Generated record NOI and EBITDA(a) of $105 million ($34.03/bbl) and $90 million ($29.31/bbl), respectively, as compared to $28.9 million ($13.84/bbl) and $18.3 million ($8.77/bbl), respectively, in 2020.

-

Successful 2021 capital program. Executed an $82 million Capex program (originally budgeted at $101 million), deferring some non-essential infrastructure projects into 2022 to match with higher Brent pricing and more fluid labor movement.

-

Positive 2021 free cash flow. Generated annual net positive free cash flow(a) before changes in non cash working capital and debt service of $8.4 million, a first for PetroTal.

-

True up revenue realized. Received true-up payments from Petroperu of approximately $28.6 million in 2021 from oil reaching the Bayovar port and being sold at a higher price than originally received at pump station 1 of the ONP, enhancing financial metrics, and provided tailwind liquidity throughout the year.

-

Scalable lifting costs. Maintained total lifting costs between $5.1 and $5.5 million per quarter in 2021 demonstrating significant scalability as production grew 60% from Q4 2020 to Q4 2021. On an annualized basis lifting costs were $21.5 million ($6.99/bbl) for 2021 compared to $15.7 million ($7.51/bbl) in 2020.

-

Variable costs impacted by higher Brent pricing. Diluent and barging costs were $23.7 million ($7.68/bbl) in 2021 as compared to approximately $14.3 million ($6.85/bbl) in 2020. Increased per barrel metrics are attributed to higher barging diesel, diluent, and floating storage costs in 2021, compared to 2020.

-

Reduced G&A per barrel. 2021 G&A of $14.3 million ($4.63/bbl) compared to $10.6 million ($5.07/bbl) in 2020, demonstrating a per barrel reduction of 10% and less than a 10% burden on adjusted EBITDA margins.

-

Record 2021 net income. 2021 net income was a record $63.2 million ($0.08/share) compared to a net loss of $1.5 million ($0.00/share) in 2020 driven by higher commodity prices, sales volumes and a derivative gain related to sales volumes moving through the ONP valued at a higher Brent price compared to initial entry into the ONP.

Operation and Financial Highlights Subsequent to December 31, 2021

-

Leverage reduction. Due to early robust 2022 free cash flow generation and strong liquidity, PetroTal elected to repay $20 million of the original $100 million bond issue, on April 1, 2022, reducing its total long term debt to $80 million, thereby lowering future interest costs.

-

Exceptional continued well performance. Achieved a 10 day record production level for well 10H of 10,050 bopd allowing the Company to set a new total production record of 20,891 bopd for February 2022, and well payout in under a month.

-

CPF-2 approved. Received approval by Peruvian regulators for full commissioning and fluid processing of CPF-2 so that up to 26,000 bopd can be processed by PetroTal.

-

Free cash flow focused 2022 budget. On February 22, 2022, PetroTal announced a $120 million fully funded capital program that could potentially generate up to $230 million of free cash flow in 2022, allowing the Company the optionality to redeem the remaining $80 million in bonds early and implement its return of capital to shareholders strategy in Q4 2022, subject to Board approval.

-

TSX-V award winner and OTCQX Best Market upgrade. PetroTal was recognized as a top TSX Venture exchange performer for 2021 ranking 10th in the energy sector and in mid January 2022, PetroTal upgraded to the OTCQX Best Market in the United States under the ticker symbol PTALF.

-

Establishment of the 2.5% social trust brings interim dispute. The establishment of the 2.5% social trust brought some anticipated demands from a minority group wanting to control the trust capital allocation process. This resulted in the Company’s oil loading dock been blocked for five weeks requiring the intervention of Peru’s Prime Minister and the government’s full attention to the area’s social disputes.

Operational and Financial Highlights for Q4 2021

-

Continued production growth. PetroTal produced 10,147 bopd and averaged 7,242 bopd in sales, which was impacted by social disruptions at the ONP, along with intermittent downtime leading to constrained production schedules, compared to Q3 2021 production and sales of 9,508 bopd and 9,142 bopd, respectively.

-

20,000 bopd production target achieved. The Company, with boosts from well 8H and 9H, achieved a five day trailing production rate of 20,000 bopd ending December 15, 2021, reaching its long standing target only four years after commencing operations at the Bretana oil field.

-

Completion of well 8H. Well 8H was completed in late Q3 2021 for under $12 million, had initial production rates in excess of 8,500 bopd, paying out in Q4 2021 from realized netbacks of over $38.00/bbl.

-

Completion of well 9H. Well 9H, completed in early December 2021, achieved approximately 9,000 bopd in early testing, averaging 8,200 bopd for the subsequent ten-day period.

-

Strong net operating income despite constrained sales. PetroTal generated $25.7 million in net operating income in Q4 2021, a decrease from $29.6 million in Q3 2021, driven by lower sales volumes stemming from social protests in November and December 2021.

-